dependent care fsa limit 2021

The American Rescue Plan boosts the dependent care FSA limit to 10500 for 2021. But a new bill from Congress passed last week and is changing that.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

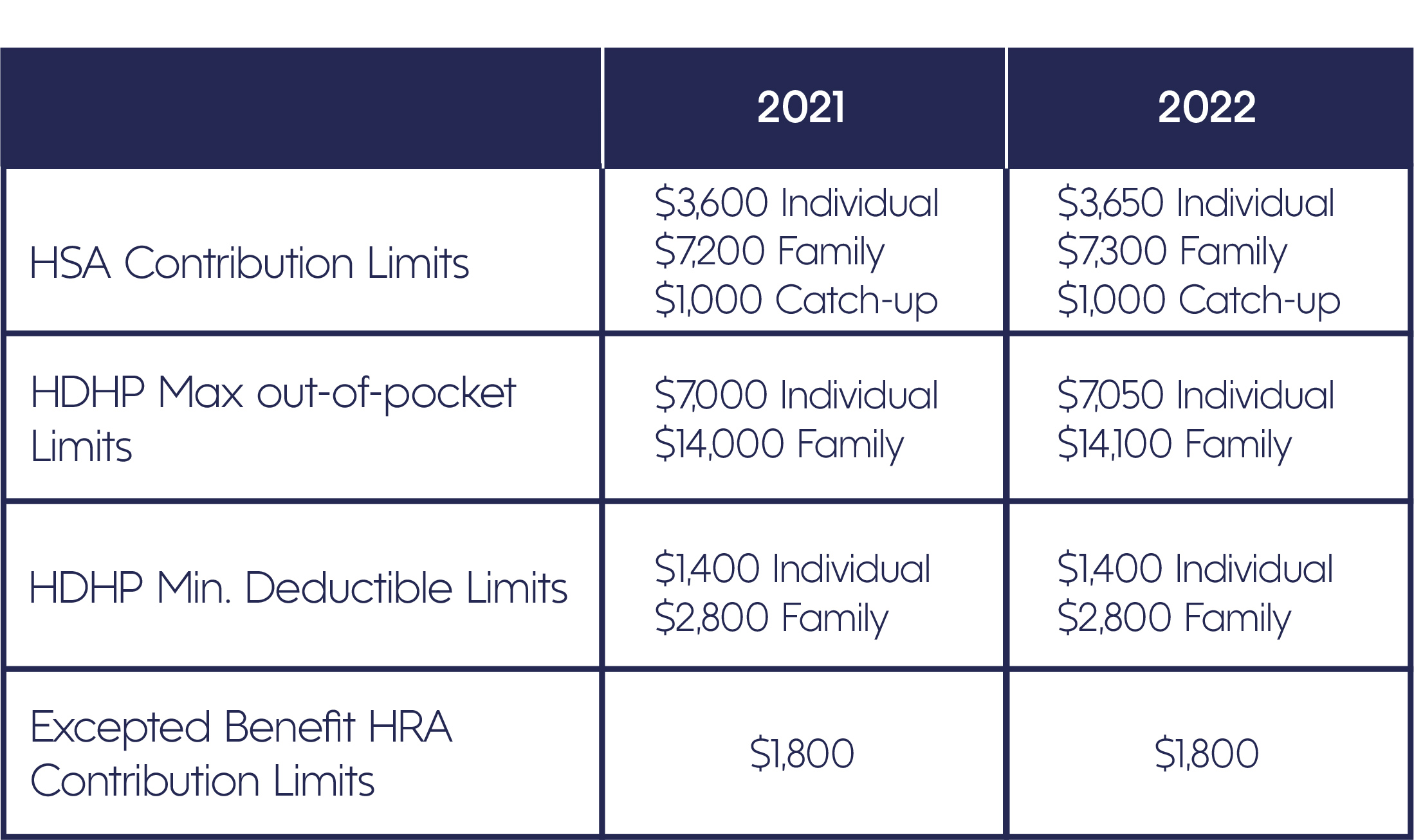

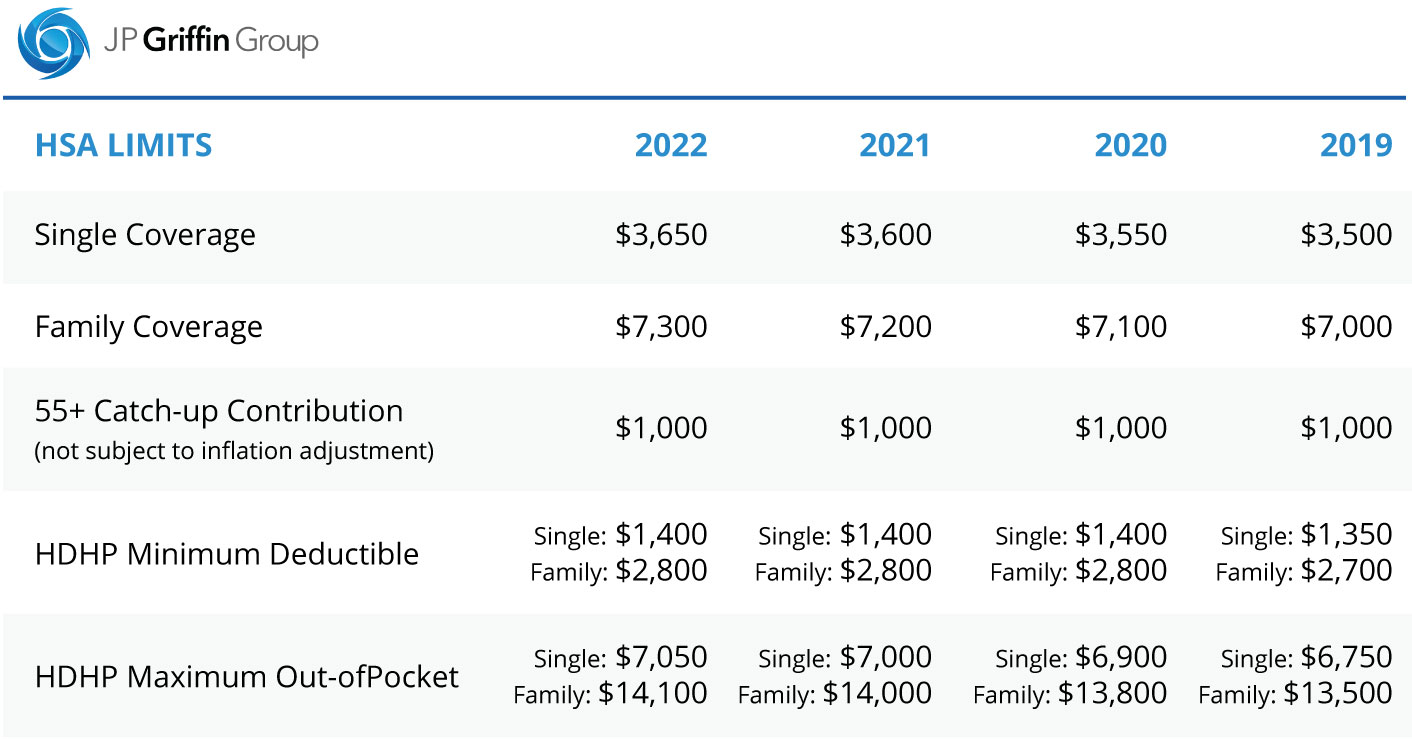

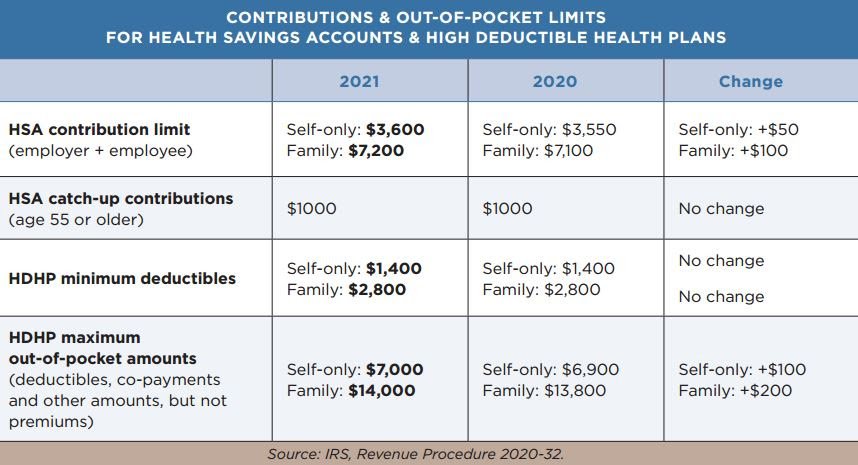

The 2022 family coverage HSA contribution limit increases by 100 to 7300.

. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. This is an increase of 100 from the 2021 contribution limits. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. If a child turned 13 in the 2020 plan year AND the. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses.

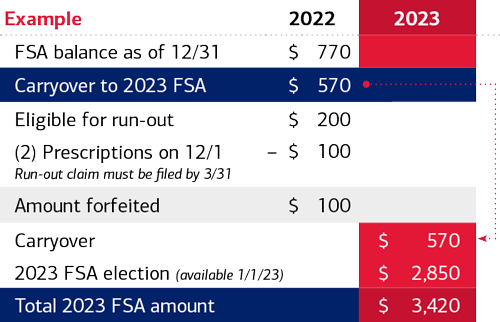

The Consolidated Appropriations Act allows for unused DCFSA money to roll over from 2020 to 2021 plans and from 2021 to 2022 plans. The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s. However due to COVID-19 the age limit was bumped to age 14 in 2021 for any unused 2020 money.

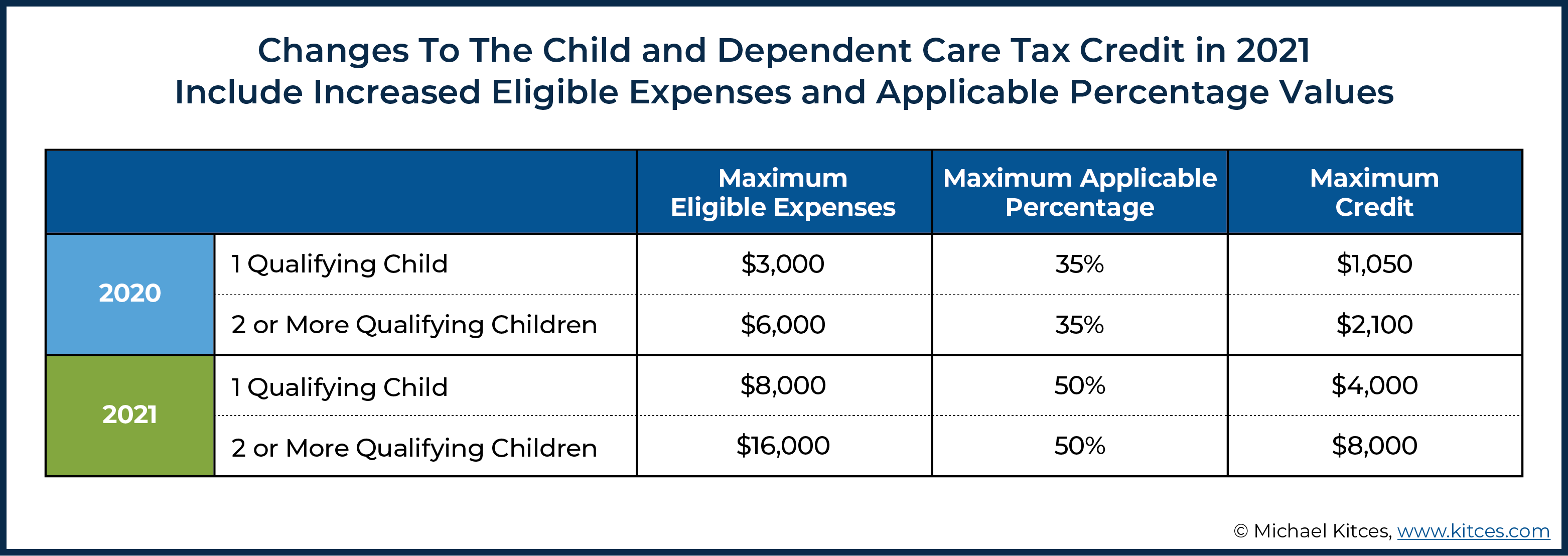

Passed in March by President Joe Biden the American Rescue Plan brought a series of legislative changes for 2021. Single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. The new contribution limit is.

Employers may amend their plans if they wish to. As part of the recent. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals.

Are over-the-counter medicines eligible. On March 16 2021. Dependent Care FSA Limit increased to 10500 from 5000 for married couples.

The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to 550.

The American Rescue Plan Act of 2021 has affected both continuation coverage and the limit for dependent care FSAs. Dependent Care FSA Increase Guidance. The annual limits for dependent care assistance program amounts apply to amounts contributed not to amounts reimbursed or available for reimbursement in a particular plan or calendar.

It remains at 5000 per household or 2500 if married filing separately. Dependent Care Tax Credit. That means if you have at least 10500 in childcare expenses again this includes wages paid.

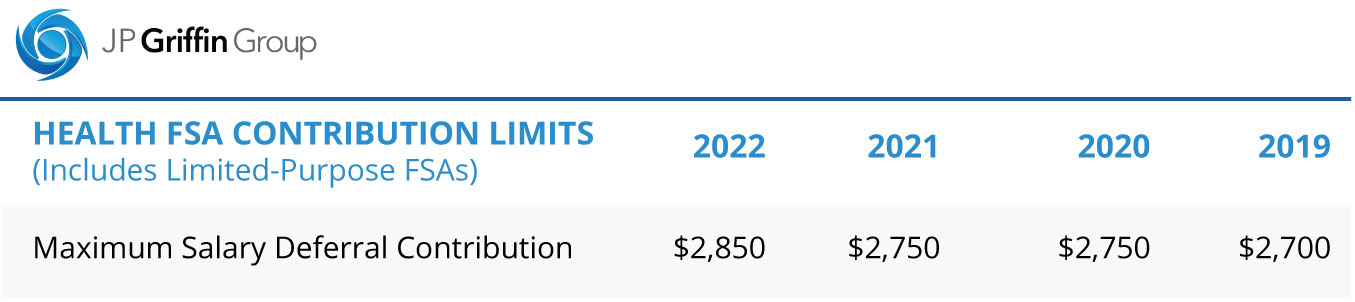

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. For 2022 the FSA carryover has been raised to 570 Normally a. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

For calendar year 2021 the dependent care flexible spending account FSA pretax contribution limit increases to 10500 up from 5000 for single taxpayers and married couples filing jointly. The Savings Power of This FSA. Background The Consolidated Appropriations Act of.

Dependent care fsa increase to 10500 annual limit for 2021 june 17 2021 on march 11 2021 the american rescue plan act of 2021. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

The minimum annual election for each FSA remains unchanged at 100. The carryover limit is 550 for the 2021 income year IRS Revenue. Health and Dependent Care FSA Carryover.

Employers can choose whether to adopt the increase. Typically the maximum age for a child to qualify for dependent care through an FSA is 13. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

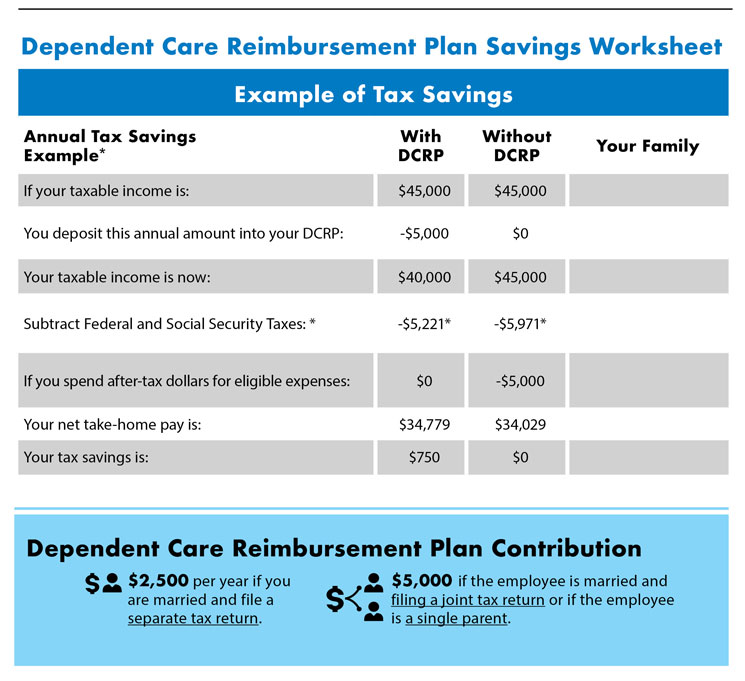

If you are interested in making a change to your DCFSA. Remember you must have a qualifying high deductible health plan HDHP to be eligible for an HSA. Depending on a few factors like where you live and your total income you could save anywhere from 35 to 46 percent on the funds you place in a dependent care FSA.

However it is up to the employers to allow employees to adjust the contributions Companies are not required to adopt any of the allowed changes. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. What is the 2021 HSA contribution limit.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycareIts a smart simple way to save money while taking care of your loved ones so that you can continue to work. ARPA Dependent Care FSA Increase Overview. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

Dependent Care FSA limit for 2021 - 10500 03-23-2021 0551 AM. Depending on a few factors like where you live and your total income you could save anywhere from 35 to 46 percent on the funds you place in a dependent care fsa. Just wanted to make you aware.

HSA limits for 2021 have increased to 3600 for self-only coverage or 7200 for family. Dependent care fsa limit 2021. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC.

As more companies adopt the. The Internal Revenue Service IRS has recently issued Notice 2021-26 which provides tax guidance for various provisions that have recently changed for Dependent Care Flexible Spending Accounts DC FSAs which are sometimes also referred to as Dependent Care Assistance Programs DCAPs. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit.

For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is increased from 5000 to 10500 for individuals or married couples filing jointly and from 2500 to 5250 for married individuals filing separately. The dependent care FSA contribution limit will remain at 5000 for 2021. While it is optional we have decided to adopt this change.

The increase in the DCFSA contribution limit is optional. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022.

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Why You Should Consider A Dependent Care Fsa

Coh Dependent Care Reimbursement Plan

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Irs Announces Fsa And Parking Transit Limits For 2021 24hourflex

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Understanding The Year End Spending Rules For Your Health Account

What Is A Dependent Care Fsa Wex Inc

Child Care Tax Savings 2021 Curious And Calculated

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Arpa And Increased Dependent Day Care Fsa Limit

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning