cat stock dividend growth rate

Looking at this fiscal year CAT expects solid earnings. This means it paid out 46 of its trailing 12-month EPS as dividend.

Is Caterpillar Stock Worth Buying For 2021 The Motley Fool

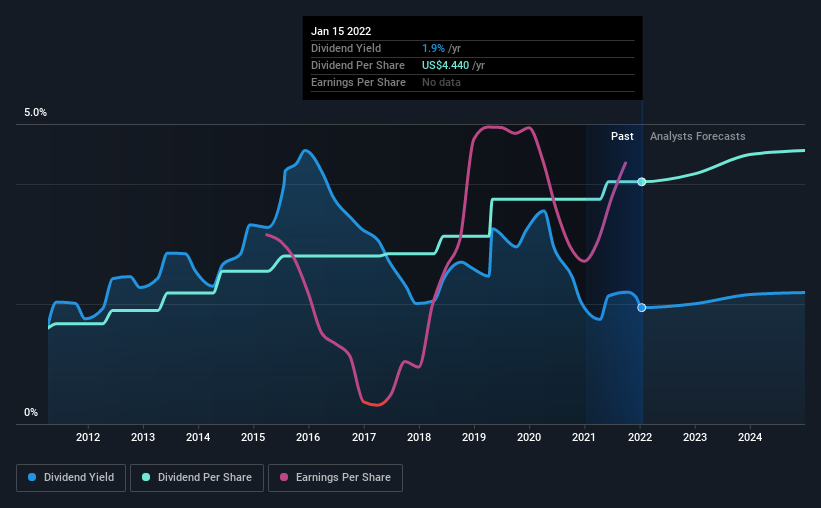

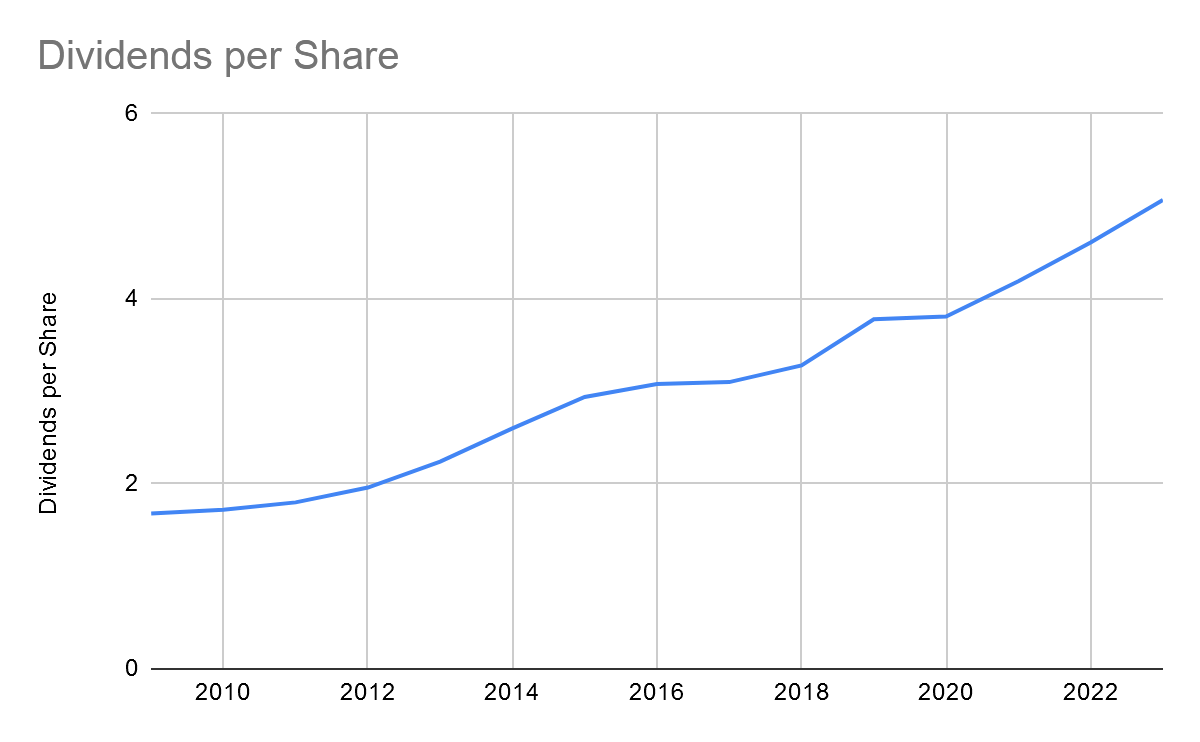

The historical rate of dividend growth.

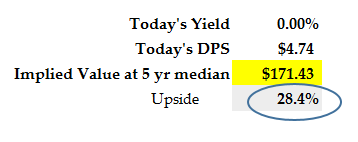

. Caterpillars current payout ratio is 46. Dividend Yield 217 Annual Dividend 444 Ex-Dividend Date Apr 22 2022 Payout Frequency Quarterly Payout Ratio 3630 Dividend Growth 777. The dividend is paid every three months and the last ex-dividend date was Apr 22 2022.

Find the latest dividend history for Caterpillar Inc. P0 current price of share of Caterpillar Inc. Currently paying a dividend of 111 per share the company has a dividend yield of 228.

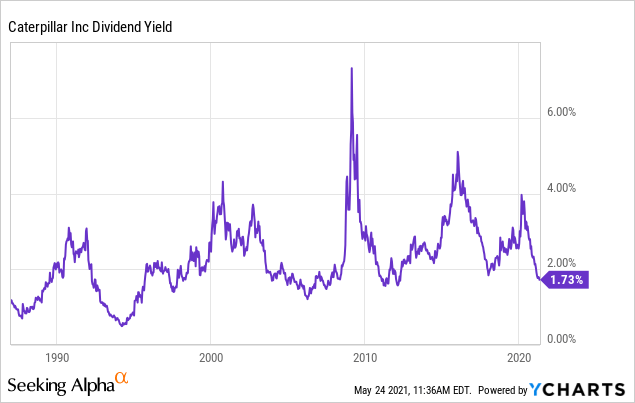

During the past 13 years the highest 3-Year average Dividends Per Share Growth Rate of Caterpillar was 7080 per year. In comparison the Manufacturing - Construction and Mining industrys yield is 096. Right now Caterpillars payout ratio is 41 which means it paid out 41 of its trailing 12-month EPS as dividend.

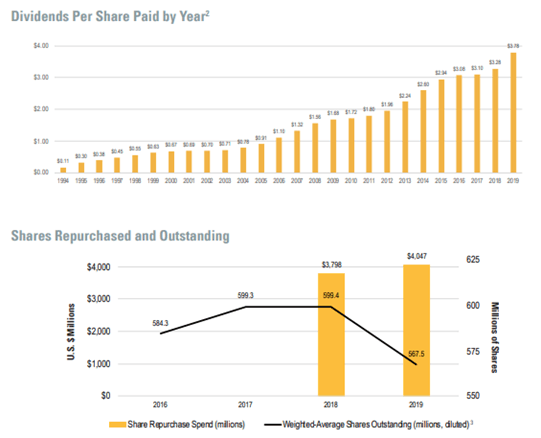

Over the past three years Caterpillars dividend has grown by an average of 907 per year. NYSECAT stock is about to trade ex-dividend in 3 days. Caterpillar annual common stock dividends paid for 2021 were -2332B a 397 increase from 2020.

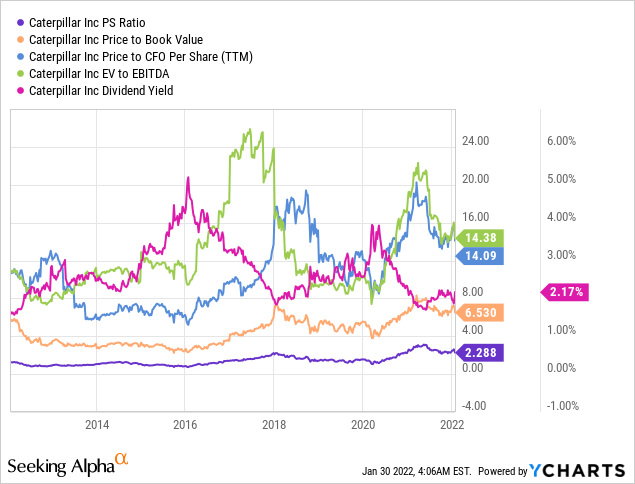

Caterpillar Dividend Information Caterpillar has a dividend yield of 217 and paid 444 per share in the past year. In comparison the Manufacturing - Construction and Mining industrys yield is 095. Yield payout growth announce date ex-dividend date payout date and Seeking Alpha Premium dividend score.

In the last 10 years Caterpillar has lifted its dividend by approximately. Each of the CAT dividend growth tables by year are listed below and overall the 1996 to 2021 simple average CAT dividend growth rate 1070 with the worst CAT dividend. The current dividend payout for stock caterpillar inc.

When did Caterpillar last increase. The lowest was -2060 per year. During the past 12 months caterpillars average dividends per share growth rate was 390 per year.

2 days agoLooking at this fiscal year CAT expects solid earnings growth. Each of the CAT dividend growth tables by year are listed below and overall the 1996 to 2021 simple average CAT dividend growth rate 1070 with the worst CAT dividend growth rate. In comparison the Manufacturing - Construction and Mining industrys yield is 093.

Dividend Growth History 2015K followers 20827 -482 -226 149 PM 051822 NYSE IEX real time price Summary Ratings Financials Earnings Dividends Valuation Growth. Looking at this fiscal year CAT expects solid earnings growth. Caterpillar NYSECAT has increased its dividend for the past 28 consecutive years.

And the median was 990. Caterpillar Incs Yearly Dividend Growth 5 Years. The Zacks Consensus Estimate for 2022 is 1258 per share with earnings expected to increase 1637 from the year ago period.

During the past 3 years the average dividends per share growth rate was 930 per year. Common stock D0. 133 rows Dividend History DIVIDEND PAYMENT SCHEDULE - A RECENT.

Caterpillar Inc raised its annual dividend in Dec 31 2021 by 399 to 425. Currently paying a dividend of 111 per share the company has a dividend yield of 222. What is a Dividend.

Future dividend growth will depend on earnings growth as well as payout ratio which is the proportion of a companys annual earnings per share that it pays out as a dividend. Dividend growth rate g implied by Gordon growth model g 100 P0 r D0 P0 D0 100 where. Assuming annual dividend growth rate of 1094 dividends double every 67 years.

CAT Dividend Data Stock Data Avg Price Recovery 97 Days Best dividend capture stocks in May Payout Ratio FWD 3039 Years of Dividend Increase 28 yrs Dividend. What track record does Caterpillar have of raising its dividend. Caterpillar annual common stock dividends paid for 2020 were -2243B a 521.

CAT Caterpillar Inc. Currently paying a dividend of 103 per share the company has a dividend yield of 219.

Here S Why You Should Hold On To Caterpillar Cat Stock Now

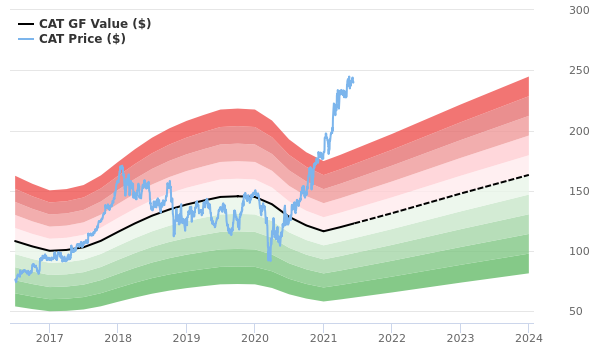

Caterpillar Stock A Bargain Or Dead Cat Bounce

Why You Might Be Interested In Caterpillar Inc Nyse Cat For Its Upcoming Dividend Simply Wall St News

Caterpillar Stock Is Estimated To Be Significantly Overvalued

Caterpillar A Cyclical Yet Safe Dividend Stock Nyse Cat Seeking Alpha

Caterpillar S Expected Dividend Hike And Buybacks Will Push The Stock Higher Nyse Cat Seeking Alpha

How To Buy And Build A Caterpillar Position Nyse Cat Seeking Alpha

Caterpillar Is A Great Dividend Stock And Has Room To Grow Cat R Dividends

Exxon Mobil A Top Ranked Safe Dividend Stock With 7 4 Yield Xom Nasdaq

Caterpillar Valuation Decreases The Stock S Attractiveness Nyse Cat Seeking Alpha

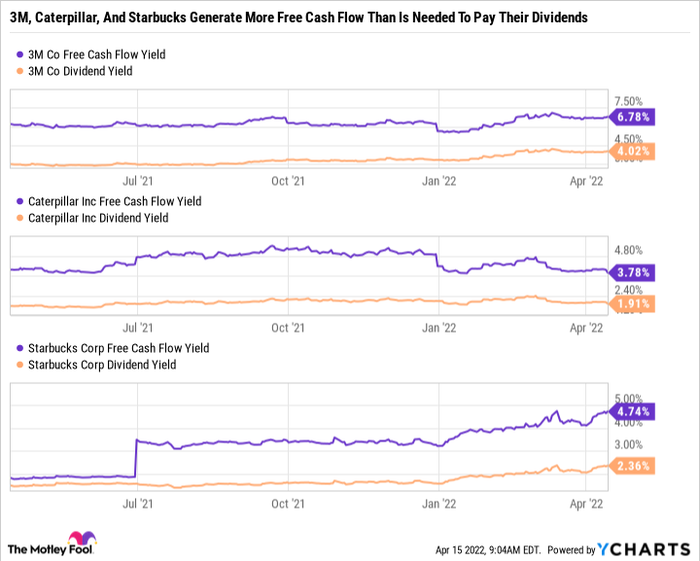

3 Dirt Cheap Dividend Stocks You Can Buy And Hold Forever The Globe And Mail

Caterpillar Transforming Itself Into Stable Growth And Earnings Nyse Cat Seeking Alpha

Is Caterpillar A Value Stock To Buy Now The Motley Fool

Caterpillar S Earnings Look Like And Act Like A Caterpillar Moving Slowly But Steady Fast Graphs

Is Caterpillar Stock A Buy The Motley Fool

Caterpillar S Expected Dividend Hike And Buybacks Will Push The Stock Higher Nyse Cat Seeking Alpha

3 High Yield Dividend Stocks That Just Went On Sale The Motley Fool